NFTs - FinTech's latest Legal headache?

NFTs are on the bleeding-edge of 'Crypto' financial technology. But what are the financial and legal implications, and how can consumers and businesses be protected?

NFTs belong to the bleeding-edge of 'Crypto' Blockchain technologies taking the financial world by storm. Used for the trading of digital artwork, authenticating documents, and even funding TV series, Silicon Valley executives and talking heads from across the internet have rushed to capitalize on the growing hype.

But questions are being asked about the legal and financial implications of this technology's rapid proliferation, and what – if anything – can be done to protect consumers and businesses from a possible financial bubble.

What is an NFT?

In principle, Non-Fungible Tokens (NFTs) are a cryptographic asset on a blockchain, which uses a unique identification code to distinguish itself from others. In plain English, this is just a digital token which uses Blockchain technology to distinguish itself from any other token.

This is where the fungibility aspect of the name comes in: 'fungibility' is the characteristic of objects which means they are mutually interchangeable. Whilst most cryptocurrencies like Bitcoin are fungible (all individual bitcoins are identical and exchangeable), NFTs are non-fungible, meaning that each one is individually unique.

The fact that NFTs use Blockchain technology means that any particular identification code associated with an object is incredibly complex, and impossible to copy on the digital ledger.

And this is where the token part comes in; digital images and artworks stored as PNGs, JPEGs, GIFs, etc., can be 'tokenized' – giving them a unique identification code on the Blockchain ledger. If that identification code is present on your part of the ledger, then you have the exclusive ownership over the NFT.

Although NFTs can in principle be used on any platform which gives users easy access to the Blockchain, most exist on Ethereum (a platform which both trades cryptocurrencies, and keeps track of which users own which identification codes).

As you may have already guessed, since any physical or digital item, moment, artwork, etc. can exist in the digital medium, practically anything can be tokenized. This has led to a wave of tokenizing different items – including digital pet rocks, the first ever tweet, NBA highlights, and famous movie moments (such as from Tarantino's Pulp Fiction).

Whilst you don't actually own the physical item (more on this later), you own the identification code associated with that digital item – and get all the social status and satisfaction arising from it. In many ways, NFTs act like a receipt does in the real world – a proof of transaction which cannot be replicated, but which is not the same as the actual item purchased.

There's a lot more to NFTs and their complex relation to crypto – as well as how crypto firms actually tokenize digital 'things' – but this is enough to give you an basic understanding of the essential properties which make NFTs a key legal and financial issue.

(if you want more information about how Blockchain actually works, check out my article on cryptocurrencies here).

How can NFTs be used?

Essentially, NFTs tap into two atavistic human desires: to own and to collect. Just like the new iPhone that everyone wants, owning a coveted NFT grants great satisfaction. And just like trading card games like Pokémon or FIFA, people chase after the pleasure of building their own complete collection of NFTs.

But the usage of NFTs transcends the pursuit of collecting digital, 'crypto-art' – platforms like Ethereum have seen an uptake in new, creative use-cases.

For instance, the online cartoon series Stoner Cats uses its own NFTs to allow purchasers to view the show. Additionally, these NFTs also confer rights to vote each week on the direction of characters and plots within the series.

The idea of other rights being granted to the owners of NFTs is seen in the NBA Top Shot platform, which grants some limited licensing rights to the clips for the owners of the relevant NFTs.

More broadly, as a unique, encrypted, and non-replicable token, NFTs have the potentiality for genuine uses in authentication – such as academic and medical records, patents, and supply chains.

Okay, so what's the problem?

Whilst the above uses of NFTs are both innovative and exciting, there are more concerning and potentially damaging uses that appear more dominant in the market. These can be understood through both sides of FinTech:

Financial implications:

First, a worrying use of NFTs – as with any potentially revolutionizing technology – is speculative trading. This is where people decide to buy things, primarily for the reason that they expect to sell it for higher – for NFTs, this means only purchasing not for inherent utility, but only with the expectation of making a profit from rising asset prices.

This practice is as old as time, and isn't necessarily a problem (speculation in the Forex markets, for instance, is a key part of most modern economies). But it is inherently volatile and risky, and can form the basis of a market bubble. This is where there is so much hype about a certain commodity – and so many people buying it just because they expect to sell it to someone else at a higher price – that the size of the market continues to inflate, until people realize that the commodity is incredibly overvalued and the price won't continue to rise. People all start to panic-sell, causing the bubble to burst.

In other words, people realize that there isn't going to be a bigger idiot to sell to.

These bubbles are a regular symptom of deregulated capitalism – particularly when a new technology brings many new optimistic traders into the market – and were behind the 2008 Financial crisis, 1990s Dot-com bubble, and even as far back as the 1637 Dutch Tulip Mania.

Bubbles can be incredibly damaging for consumers and businesses, as well as the economy as a whole. Economists are constantly looking for the next big bubble, and trying to find ways to slowly release pressure, rather than waiting for it to burst (for example, the Chinese property market). Key characteristics of bubbles are rapidly rising asset prices, high trading volumes, and a frenzied hypermania about a particular commodity.

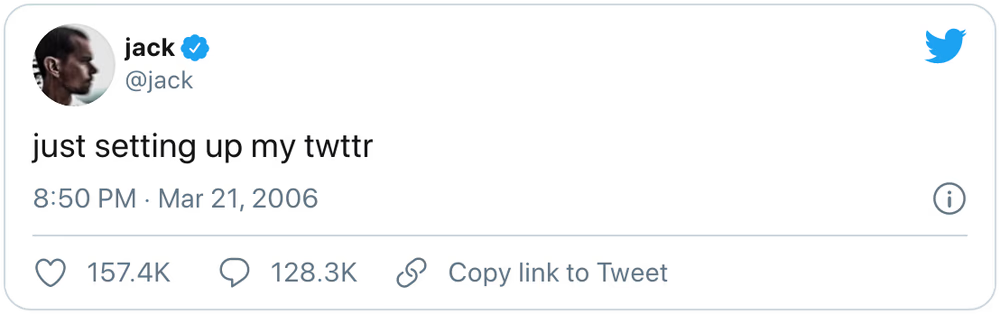

And the NFT market shows many of these characteristics. For example, there is currently a LOT of money in trading. The first tweet ever on Twitter (by Jack Dorsey), was sold for more than $2.9 million, and the NBA Top Shot highlights (like LeBron James' Series 1 dunk from the top) are selling for hundreds of thousands of dollars.

But it's worth asking where exactly these valuations of NFTs are coming from – does that tweet actually give the owner $2.9 million-worth of satisfaction? Or are people willing to pay a high price because they're guessing that someone else will be willing to pay even more?

It's important to also note that at the time of writing, there are signs that this bubble is already bursting – trading volumes from January to October 2022 fell by a staggering 97%. But despite this, NFT trading continues and without any changes to the legal or financial regulation of NFTs, there is a risk of the bubble reinflating.

Legal implications

This dovetails into the second main problem with NFTs: ownership. First, the considerable lack of regulation regarding how NFTs are advertised has led to many consumers misunderstanding what ownership they were actually purchasing was. On the NBA Top Shot website, it boldly advertises that you can 'buy' your favorite moments – yet the Copyright licensing remains in control of the NBA, and you don't actual have any ownership of the video clip itself. The same criticism is often levelled at Bored Ape Yacht Club, in which consumers are led to believe that they are buying the digital artworks (and the rights to them) – whereas in fact all they will own is the digital identification code, and a line in the digital Blockchain ledger as proof of purchase.

The lack of clear government regulation leads to serious questions about false advertising, and whether NFT-sellers have a legal responsibility to educate potential consumers about exactly what it is they are buying.

Second, contract law states that only the original parties in a contract are in privity (that is, they are protected and involved in the provisions of the original contract). But this means that downstream buyers (those that buy from the original buyer, etc.) are not included in the original contract, so have no legal protection if, for instance, the company decided to remove the other benefits and rights associated with ownership of the NFT. So, if you buy an NBA Top Shot NFT from someone else, you are not legally entitled to the limited licensing rights by sole cause of you owning the NFT. And this is all assuming that there is even a contract in the original purchase (there often isn't!).

Clearly, all of this puts serious doubt into the utility of the NFT trading markets, wherein the only thing that the Blockchain technology can guarantee is the proof of purchase on the digital ledger – no ownership, licensing, or protection of the law for other benefits promised!

Should we be worried?

As with most areas of Financial Technology, government regulatory clarity over NFTs has been slow to meet the pace of innovation. This has led to a 'wild west' of scamming, rug-pulling, pump-and-dumps, and other malicious behavior which targets new consumers and businesses in the market.

But perhaps the most worrying sign is of the growing speculative trading of NFTs, and the size of the bubble that has emerged as a result. As mentioned, this bubble has began to burst, leaving those too slow to sell with huge financial losses, and overall trading volumes crashing. And whilst it might seem that NFTs are over, trading continues nonetheless; without regulatory changes, the same process of financial volatility risks repeating itself.

References

"Non-Fungible Token (NFT): What It Means and How It Works", Investopedia.

"How Crypto will Change the World (or Not)", Johnny Harris.

"NFTs, Explained", Johnny Harris.

"NFTs Are Legally Problematic ft. Steve Mould & Coffeezilla", Legal Eagle.

"10 Practical NFT Use Cases Beyond Digital Artworks", Hong Kiat.

"Speculation: Trading With High Risks, High Potential Rewards", Investopedia.

"NFT Trading Volume has Fallen 97% Since the Beginning of the Year", PetaPixel.

"Quentin Tarantino settles NFT lawsuit with Miramax", The Verge.

For more information about the products mentioned in this article:

- Tarantino NFT Collection https://tarantinonfts.com/

- Stoner Cats https://www.stonercats.com/

- NBA Top Shot https://nbatopshot.com/

- Bored Ape Yacht Club https://boredapeyachtclub.com/#/